Renters Insurance in and around Jamestown

Renters of Jamestown, State Farm can cover you

Coverage for what's yours, in your rented home

Would you like to create a personalized renters quote?

Protecting What You Own In Your Rental Home

Your rented townhome is home. Since that is where you make memories and kick your feet up, it can be beneficial to make sure you have renters insurance, even if your landlord doesn’t require it. Even for stuff like your towels, fishing rods, boots, etc., choosing the right coverage can help protect your belongings.

Renters of Jamestown, State Farm can cover you

Coverage for what's yours, in your rented home

State Farm Has Options For Your Renters Insurance Needs

It's likely that your landlord's insurance only covers the structure of the apartment or townhome you're renting. So, if you want to protect your valuables - such as a coffee maker, a bedding set or a set of golf clubs - renters insurance is what you're looking for. State Farm agent Austin Andrews wants to help you understand your coverage options and protect yourself from the unexpected.

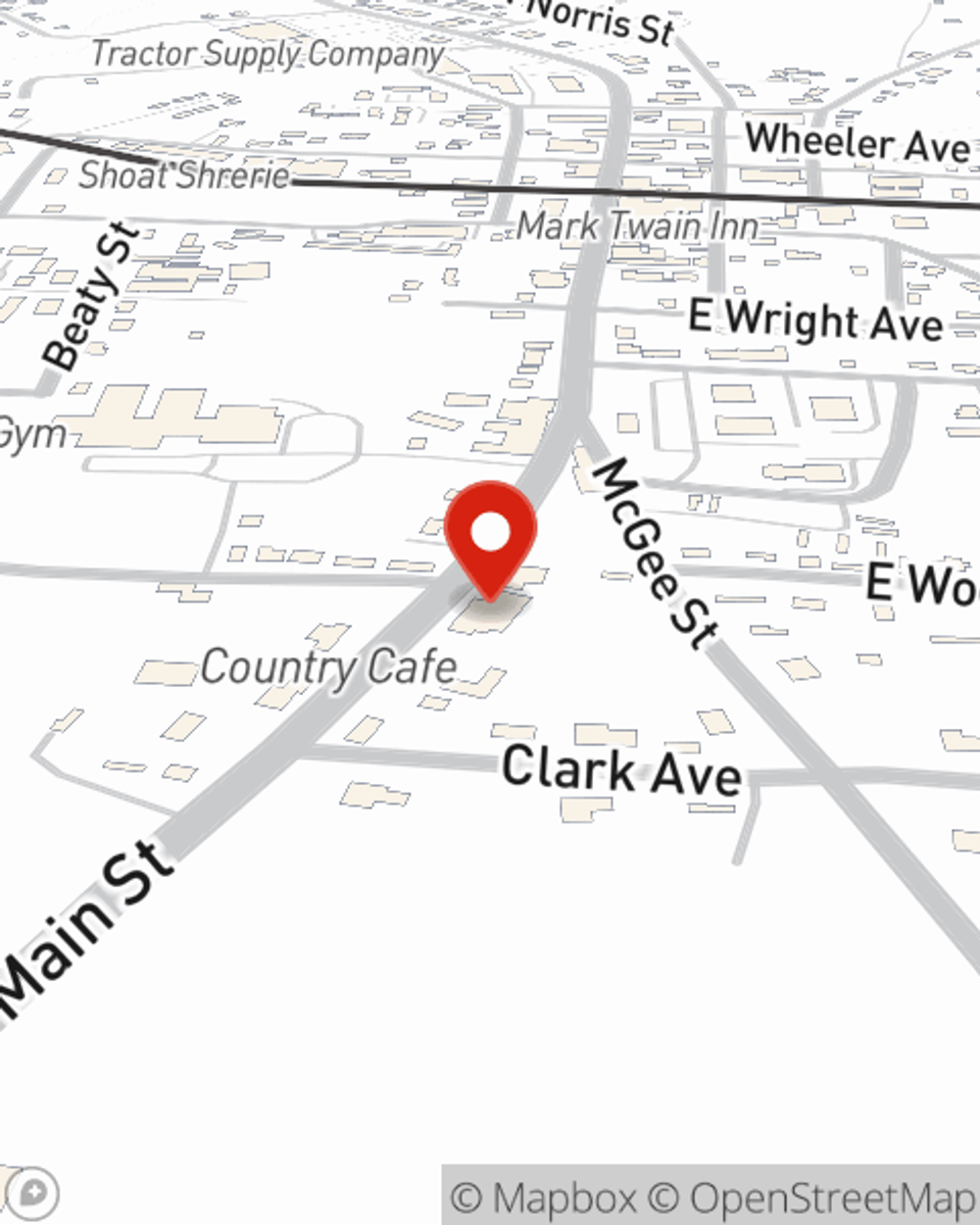

Visit Austin Andrews's office to discover how you can save with State Farm's renters insurance to help keep your personal property protected.

Have More Questions About Renters Insurance?

Call Austin at (931) 879-5891 or visit our FAQ page.

Simple Insights®

Moving? Don't forget to make insurance changes, too

Moving? Don't forget to make insurance changes, too

Before you move, talk with your agent about move insurance and moving your current policies. Read why transferring insurance is so important.

Compare different types of mortgages

Compare different types of mortgages

Knowing the different types of mortgages can be confusing. Learn the different mortgage types and determine what may work best for you.

Austin Andrews

State Farm® Insurance AgentSimple Insights®

Moving? Don't forget to make insurance changes, too

Moving? Don't forget to make insurance changes, too

Before you move, talk with your agent about move insurance and moving your current policies. Read why transferring insurance is so important.

Compare different types of mortgages

Compare different types of mortgages

Knowing the different types of mortgages can be confusing. Learn the different mortgage types and determine what may work best for you.